The MPC’s problem: explained, but not solved

February 25, 2011 Leave a comment

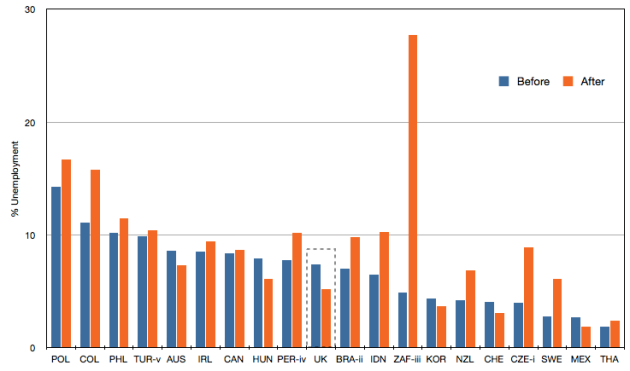

Some interesting research* on the UK’s inflation expectations was published this week by the Bank for International Settlement. The research helps explain, but not solve, the credibility problem bedevilling the Bank of England’s Monetary Policy Committee (MPC).

Some interesting research* on the UK’s inflation expectations was published this week by the Bank for International Settlement. The research helps explain, but not solve, the credibility problem bedevilling the Bank of England’s Monetary Policy Committee (MPC).

Does it matter if consumers’ views differ from that of the MPC? It matters a lot, because inflation expectations can affect real inflation. Read more of this post